We specialize in Los Angeles Social Security Disability Matters.

Social Security Disability (SSD) ● Supplemental Security Income (SSI) Cash Assistance Program for Immigrants (CAPI) ● Medi-Cal

If you

Are out of work

Are under the age of 65

Are in chronic pain

Have a physical or mental illness

You could qualify. Contact Us Now.

RCM Disability Free Evaluation

Call: 818-502-1951

The Application

We will help you fill out all the necessary forms required by Social Security.

Dealing with the Government

Our office will take care of your case for you. You will not need to talk to your case worker.

Peace of Mind

We have been winning disability benefits for our clients for over 20 years. We will help make this process as stress-free as possible

We’re Always Here

A human being with knowledge of your case is one phone call away. No automated systems, and no touch-tone phone required.

About RCM Disability Attorneys in Glendale

RCM Disability specializes in permanent Social Security Disability matters in Los Angeles, Glendale and the surrounding areas. We represent our clients from the initial level to the hearing level and beyond – you can rest assured that the RCM Disability team will be by your side every step of the process.

We understand how you feel – applying for disability is not easy. For many people, giving up our jobs and financial independence is extremely stressful and difficult. Don’t apply alone; over 60% of applications are denied at the initial level. Let us even the odds.

We are always on your side. We will not recommend any course of action that is not in your best interest. We are fully committed to getting you benefits as quickly and smoothly as possible. Your success is our success, and we will fight for you.

Get your free evaluation today.

SSDI Services

There are three types of permanent disability benefits available from Social Security. RCM Disability can help determine which one you are eligible for. The process for Social Security Disability and Supplemental Security Income is the same; Cash Assistance Program for Immigrants is a California program (not federal) and is a little bit different.

There are three steps for each disability program. The initial level is the first, and that is where we submit the original application. Around 60% of people are denied at this step. If this results in a denial, we will appeal the decision and go to the reconsideration stage. If another denial is issued, we will finally go to the hearing stage to argue the case in front of an Administrative Law Judge (ALJ).

RCM Disability in Glendale will take you through every step in the process. If you are at any step of the process and would like representation (or are unhappy with your current representation), the RCM Disability team is glad to help and will take over your case.

No payment unless the case is won.

SSD

Must be disabled and have a recorded work history to be eligible. Benefits based on taxes previously paid.

Supplemental Security Income (SSI)

Must be disabled. No work history required. Eligibility based on income and resources (we will help determine if you are eligible).

CAPI

Cash Assistant Program for Immigrants. Must be disabled and be denied for SSI due to immigration reasons.

Definition of Disability

Social Security has its own definition of disability.

Many people believe that a doctor’s note is all it takes to be found disabled. Unfortunately, without knowledge of the requirements for and definition of disability, getting benefits is all the more difficult. RCM Disability will help you prove your disability according to Social Security’s definition.

Income and Resources

To be found eligible for Supplemental Security Income (SSI), you not only have to be found disabled but must also have limited income and resources.

Our specialized staff will help determine if you qualify for SSI through our screening process. We will also give advice regarding government assistance programs so you can receive some financial assistance until your case is approved.

Southern California Disability FAQs

How Much Money Will I Get?

This depends on the program you apply to.

Social Security Disability Insurance (SSDI) payment amounts are based on the amount of taxes you have paid. You can find out how much you are eligible for by checking on the Social Security website (see our blog post [here]).

Supplemental Security Income (SSI) is for low-income individuals. The maximum payment in the state of California is $943.72 (this amount varies state to state).

You can receive both SSDI and SSI payments up to the SSI maximum.

How Long Until I Am Approved?

The process can take anywhere from 6 months to 2 years (or longer). There are several steps in the process:

Initial Application. The first step is to file an application. It usually takes 4-6 months to get a response.

Reconsideration. If your initial application is denied, the next step is to appeal for reconsideration. It will take another 4-6 months to get a response.

Hearing with a Judge. If your reconsideration is denied, you must apply to argue your case before an Administrative Law Judge. It takes about a year to get a hearing date.

So, the total time until your case is heard by a Judge is around 2 years.

Is Money Assistance Available While I Wait?

There are government assistance programs available to help while you wait. Please contact your local government welfare office to determine your eligibility.

The most common programs applicants apply for in California are General Relief and CalFresh.

My Doctor Says I Can’t Work. I Should Be Approved, Right?

No. Social Security has its own definition of “disabled.” Although your doctor may tell you that you are unable to work, Social Security does not have to accept your doctor’s opinion as fact.

Do I Get Any Other Benefits If I Am Approved?

Yes. If you get approved for SSDI, you will become eligible for Medicare after a waiting period.

If you are approved for SSI, you will receive health benefits through Medicaid (Medi-Cal in California).

How Do I Prove Disability in California?

Our recommendation is to see as many doctors as possible as often as you can to help prove your case. The more medical evidence you have, the stronger your case will be.

Am I eligible for Social Security Disability Insurance (SSDI)?

Eligibility for SSDI is simple to determine. A good rule of thumb is that you are eligible if you have paid payroll taxes for the last 5-10 years.

Each individual is entitled to a different benefit amount according to the taxes paid. To find out the specific dollar amount you are entitled to, you can either:

- Call your local Social Security office; or

- Obtain your “Earnings Statement” online by doing the following:

- Go to www.ssa.gov

- Click “my Social Security”

- Follow the steps to create your account (a valid email address is required)

- Access your Earnings Statement

- In your Earnings Statement, there is a line item that states: “You have earned enough credits to qualify for benefits. If you become disabled right now your payment would be about $_____.” This is your SSDI disability amount.

Am I eligible for Supplemental Security Income (SSI)?

SSI eligibility is determined based on income and resources. If you have not earned enough credits to qualify for SSDI, you may still be eligible for SSI disability benefits.

In general, to qualify for SSI, your “resources” must not be worth more than $2,000 for an individual, or $3,000 for a couple. This includes money in the bank, stocks, bonds, and retirement accounts.

Some items are not counted toward the income limit, such as:

- The house you live in;

- One vehicle;

- Burial plots; and

- Household goods and personal effects

To determine eligibility for SSI, it is best to speak with a professional to walk you through the oftentimes confusing rules and guideline.

Further, for SSI, citizenship requirements must be met. In California, if you do not meet the citizenship requirements for SSI, you may still be eligible for a form of disability from the state called the Cash Assistance Program for Immigrants (CAPI).

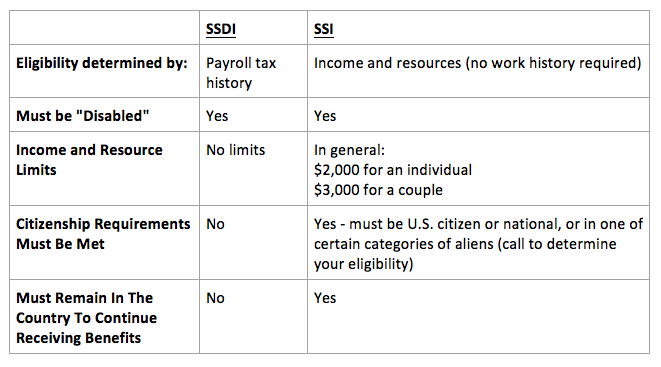

Here is a quick chart summarizing the differences between SSI and SSDI:

How Much Does A Lawyer Cost?

Social Security Disability lawyers in California do not take any money until your case is won. They work free of charge until you get paid.

You could qualify. Contact Us Now.

RCM Disability Free Evaluation

Call: 818-502-1951